¿WHO IS WHO?

At MERCHANT Lingo we do not provide merchant services, consultation or analysis of merchant statements, contracts or agreements. What we do is provide TRANSPARENT information to help you understand how merchant services works for you.

I'll try to clear up the difference between a;

using the analogy below.

The Analogy

The information or analogy provided is by NO MEANS, stating or implying anything negative towards an anyone or company. It's just to clarify, "WHO IS WHO".

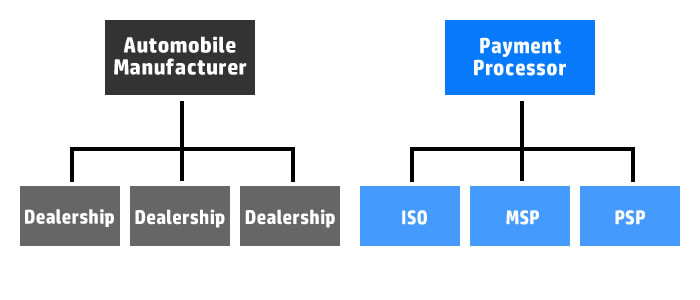

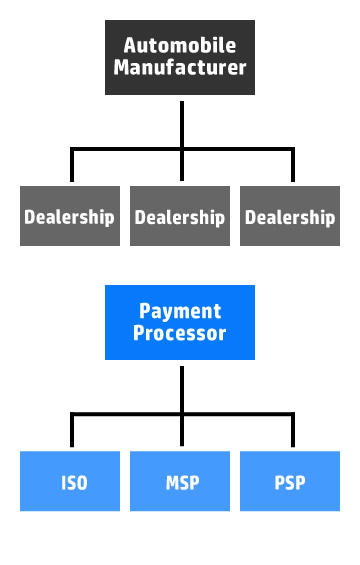

To understand the differences between a Payment Processor, Merchant Service Provider, ISO, MSP or PSP; look at the Payment Processor as an automobile manufacturer of cars and the ISO, MSP, and PSP as the car dealerships for the manufacturer. The automobile manufacturer (Payment Processor) is the source and the car dealerships (ISO, MSP and PSP) are the third party vendors who have been approved to sell services or products.

Here's a few actual payment processing companies you might know;

-Bank of America (formally BAMS)

-Chase Paymentech

-Fiserv (formally First Data)

-Adyen

-Global Payments (formally Heartland, TSYS)

The car dealerships use a MSRP sticker with two prices; Manufacturer's Suggested Retail Price (Payment Processor) and a Total Suggested Retail Price (ISO, MSP and PSP), which includes the mark-up price (Interchange-Plus, Flat-Rate, Membership/Subscription, Tiered). So needless to say, when it comes to merchant services there's not much difference between the two, ASK lot's of QUESTIONS and NEGOTIATE (pricing model), just like buying a car.

Now don't get me wrong or misunderstand, but depending on your industry/business NOT ALL pricing models can be negotiated. If that's the case, search for a provider who is willing work with you!

Lastly: If you can go DIRECT to a payment processor, that's your BEST CHOICE! If that's not possible, the next option is going with your bank.